Material Cost Escalation in 2022

Published on

2 May 2022

Written by

Aron Goldenberg

Court texte d’introduction. Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet. Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod.

Construction Market Update

Construction Trends

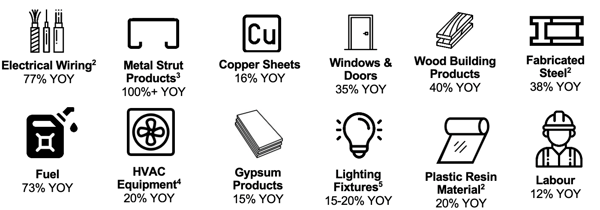

This month’s theme for the regular “SDI Construction Market Update” is material cost escalation. In recent months, commercial construction costs have observed record high prices on key building materials and there is no signs of slowing down. Demand for commercial and infrastructure spending has increased, with the Province of Quebec forecasting a nearly $1.2 billion YOY increase in infrastructure spending alone[1]. At the same time, the construction industry is subject to many of the same supply chain issues that are facing other industries. From metal products to electrical cables and wood products, shortages of key materials combined with labour shortages and skyrocketing fuel charges have driven up prices to unprecedented levels.

The health care construction industry utilizes a number of specialized products such as copper and galvanized steel for RF cabins, non-ferrous metals for MRI scan room walls and ceilings, lead shielding for radiation protection, and more. These products are subject to significant supply chain issues and substantial material cost escalations.

Key Findings for the Health Care Industry

The below items summarizes some of the key cost increases from October 2020 – October 2021[2]. Key construction materials for MRI, CT, and other biomedical equipment construction projects are steeply rising due to raw material price increases. Some of the notable affected end products include HVAC equipment, steel stud framing, t-bar ceilings, electrical wiring, windows & doors. This data is for budgeting purposes only and is based on industry research and conversations with our suppliers, and reasonable estimates.

In addition to price increases, major mechanical equipment such as fan coil units and chillers are subject to increased lead time, emphasizing the important of early planning for health care projects. SDI Canada’s project planners and estimators are recommending that customers include a contingency of 25-30% of project value for construction work with a start date of late 2022 or 2023. Our estimating and project management team is more than happy to assist with project budgeting to provide value engineering and risk mitigation strategies to reduce the impact of macro- industry cost increases.

MITIGATING STRATEGIES

Contractual & Commercial Mitigation

- Integrated Project Delivery (IPD) – Utilizing a collaborative design and construction delivery method, project consultants and subcontractors can work alongside the owner throughout the value engineering process to identify cost savings opportunities.

- CCDC-5B Contract – Utilizing a CCDC-5B construction management contract and including a maximum upset limit clause reduces the owner’s risk of cost increases. The contract enables transparent costing for project subcontractors and involves the owner in the tender process. A profit sharing clause can also be included to incentivise the general contractor and subcontractors to identify further cost savings opportunities.

- CCDC-14 Design & Build Contract – The stipulated sum Design & Build contract transfers owner’s cost risks to the general contractor, as items within scope are to be completed at a agreed-upon price. This enables accurate project budgeting and cash flow forecasting for the owner.

Design & Construction Mitigation

- Pre-ordering Long Lead Items – Many of the complicated long lead time items (such as mechanical and electrical equipment) are also subject to cost variations on a regular basis. Pre-ordering these items allows the owner to lock-in costs at the current market price and not worry about price increase in subsequent terms.

- Material & Supplier Agreements – Contractors frequently have discounted pricing on some materials/supplies. Consult with your GC if they have preferred pricing with any specific suppliers.

- Prefabricated Solutions – Consult with your project team if there are pre-fabricated solutions available either various components of the project. For example, pre-fabricated building solutions are often more cost effective than constructing a new addition to the building.

- Regional vs International Focus – Look beyond your specific geographic region for alternatives on major scope items from Canada-wide or international vendors.

Technological Mitigation

- Building Integration Model (BIM) – Utilizing BIM systems to conduct smart and precise site surveys and feasibility studies can lead to a better understanding of the essential scope items. 3D BIM models can help designers and consultants better coordinate key infrastructure services as well as more accurate cost estimating.

- Precise Project Forecasting and Dashboards – Detailed forecasting for construction activities and necessary materials will assist in prioritizing when certain materials should be ordered. Following trends of raw material commodities may further assist in determining when to place orders for volatile items such as metal products.